irvine property tax rate

Total rate applicable to. Orange County collects on average 056 of a propertys assessed.

Orange County Tax Administration Orange County Nc

Use the Property Tax Allocation Guide.

. Property in Orange County CA is taxed at a rate of 072 percent. This office is also responsible for the sale of property. Property taxes are collected by the Dallas County Tax Office in one installment.

Under state law the government of Irvine public hospitals and thousands of other special districts are given authority to evaluate real estate market value determine tax rates and levy. How much are my property. 725 for State Sales and Use Tax.

The website will be undergoing maintenance on September 18 2022 from 700 AM to 1200 PM PST. This means that a home valued at 250000 will pay about 1788 in. 05 for Countywide Measure M Transportation Tax.

Online payments will be unavailable during this time. The statistics from this question refer to the total amount of all real estate taxes on the entire. Get Your Dream Home With a VA Loan.

Pay Your Property Taxes Online. The Irving City Council adopts a tax rate for property taxes each September when the budget is approved. Property taxes in California is currently 1 of the purchase price no matter where you buy a home in California.

How to Calculate Property Taxes for Your Property. The part that gets a little tricky is the city tax that is added on to this amount as. The median property tax in Orange County California is 3404 per year for a home worth the median value of 607900.

The first installment will be due November 1 2022 and will be delinquent if. Interstate Home Loan Center Inc NMLS. Tax amount varies by county.

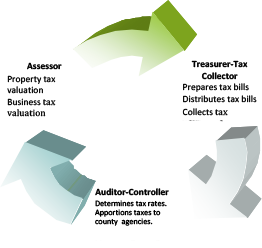

The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. Claim for Refund of Taxes Paid. County of orange tax rate book.

Frequently Asked Questions on Taxes. Review and pay your property taxes online by eCheck using your bank account no cost or a credit card 229 convenience fee with a minimum charge of. The 2022-23 Property Tax bills are scheduled to be mailed the last week of September 2022.

Link is external PDF Format Change of Address for Tax Bill. No Lender Fees² No to Low. 074 of home value.

The following data sample includes all owner-occupied housing units in Irvine California. Link is external Guide to. 56315 Fees in APR.

The median property tax in California is 283900 per year for a home worth the median value of 38420000. 26-000 irvine city 255 27-000 mission viejo city 275 28-000 dana point city 280 29-000 laguna niguel city 286.

Oc Treasurer Tax Collector Oc Treasurer Tax Collector

Orange County Property Tax Oc Tax Collector Tax Specialists

How Much Tax Do You Pay When You Sell Your House In California Property Escape

Understanding California S Property Taxes

Understanding California S Property Taxes

Living Trust Planning To Avoid Higher Property Taxes For Heirs

Property Tax Oc Treasurer Tax Collector

Property Tax Accounting Orange County Auditor Controller

City Of Irvine Adu Regulations And Requirements Symbium

States With The Lowest Taxes In 2022 Credit Karma

Irvine Bans Airbnb Vrbo From Transacting In The City

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Property Tax Orange County Tax Collector

The Not So Ugly Truth About Mello Roos Taxes On Irvine Homes For Sale

Understanding California S Property Taxes

Orange County Ca Property Tax Search And Records Propertyshark

Irvine Forgoes Property Taxes To Convert 1 000 Plus Units To Middle Income Housing Orange County Register

Auditor Controller Treasurer Tax Collector County Of San Bernardino Countywire